The expected liability under Self-Assessment (SA) is calculated based on statutory guidance outlined in Section 59A and Section 59B of the Taxes Management Act 1970, as referenced in your document.

Here’s how it works:

- Starting point – prior year’s liability

HMRC calculates your expected liability for the current tax year using your previous year’s total income tax and Class 4 NIC liability, less any tax already deducted at source (for example, PAYE or CIS). - Payments on account

- You are normally required to make two payments on account, each equal to 50% of the previous year’s net liability.

- Adjustments and balancing payment

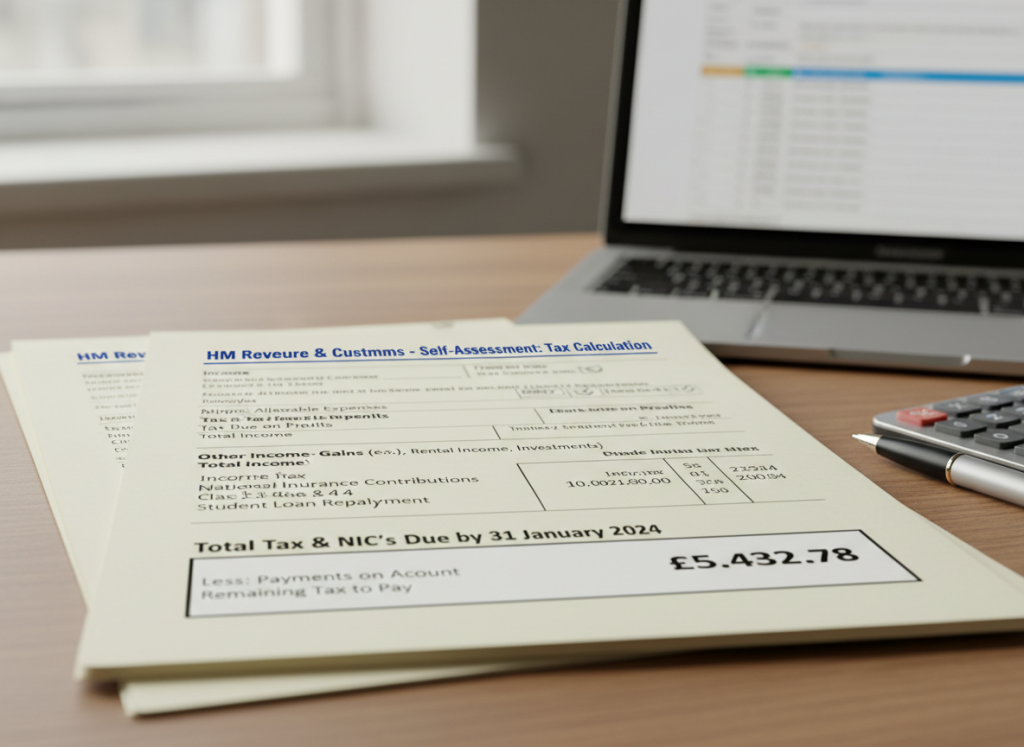

- Once your Self Assessment tax return is filed, HMRC calculates the actual liability for the year.

- The difference between the actual amount owed and what has already been paid on account becomes your balancing payment, due by 31 January following the end of the tax year (Section 59B (1) – (4)).

- Reductions or claims

You may make a claim to reduce your payments on account under Section 59A(3) and (4) if you reasonably expect your current year’s income to be lower

However, excessive reductions made negligently or fraudulently can attract penalties under Section 59A(6).

So in summary:

Expected SA liability = 100% of the prior year’s net income tax and Class 4 NIC liability (excluding tax deducted at source), paid as two equal instalments on 31 January and 31 July.

Any remaining balance is paid the following 31 January once the actual figures are known.