By HMRC rules, to be liable for Income Tax on employment income in the UK for the 2024/25 tax year (6 April 2024 to 5 April 2025), a taxpayer must meet the following criteria, focusing solely on direct employment income (e.g., salary, wages, bonuses, commissions, and taxable benefits from an employer, excluding any non-employment sources like investments, rentals, or self-employment):

- Residency and Tax Status: You must be a UK tax resident or treated as such for the tax year. Non-residents may still be liable if they have UK-sourced employment income.

- Employment Relationship: You must have an employment contract or be treated as an employee (e.g., not a self-employed contractor). This includes income from direct employment, such as pay before deductions, tips not included on your P60, and taxable benefits like company cars or private medical insurance.

- Taxable Income Exceeds Personal Allowance: Liability arises if your total taxable employment income exceeds the Personal Allowance of £12,570. Income below this is tax-free. All direct employment income counts toward this, after any allowable deductions (e.g., pension contributions or professional subscriptions).

- No Exemptions Apply: Certain income may be exempt (e.g., some disability payments or specific statutory exemptions), but standard employment pay is taxable if above thresholds.

If these criteria are met, tax is calculated progressively based on income thresholds:

- Personal Allowance: £0 to £12,570 – 0% tax.

- Basic Rate Band: £12,571 to £50,270 – 20% tax.

- Higher Rate Band: £50,271 to £125,140 – 40% tax.

- Additional Rate Band: Over £125,140 – 45% tax.

Impact of Income Thresholds:

- Personal Allowance Taper: If adjusted net income (including employment income) exceeds £100,000, the Personal Allowance reduces by £1 for every £2 over £100,000. It reaches £0 at £125,140, effectively increasing the marginal tax rate to 60% in the £100,000–£125,140 band due to the loss of allowance.

- Other Threshold Effects: Employment income over £50,270 may trigger higher rate tax, affecting reliefs like pension contributions (higher relief claimable). Income over £60,000 may activate the High Income Child Benefit Charge (a tapered charge up to 100% of benefit at £80,000+), though this is not direct tax on income but related. Student loan repayments or other deductions may also apply based on income levels.

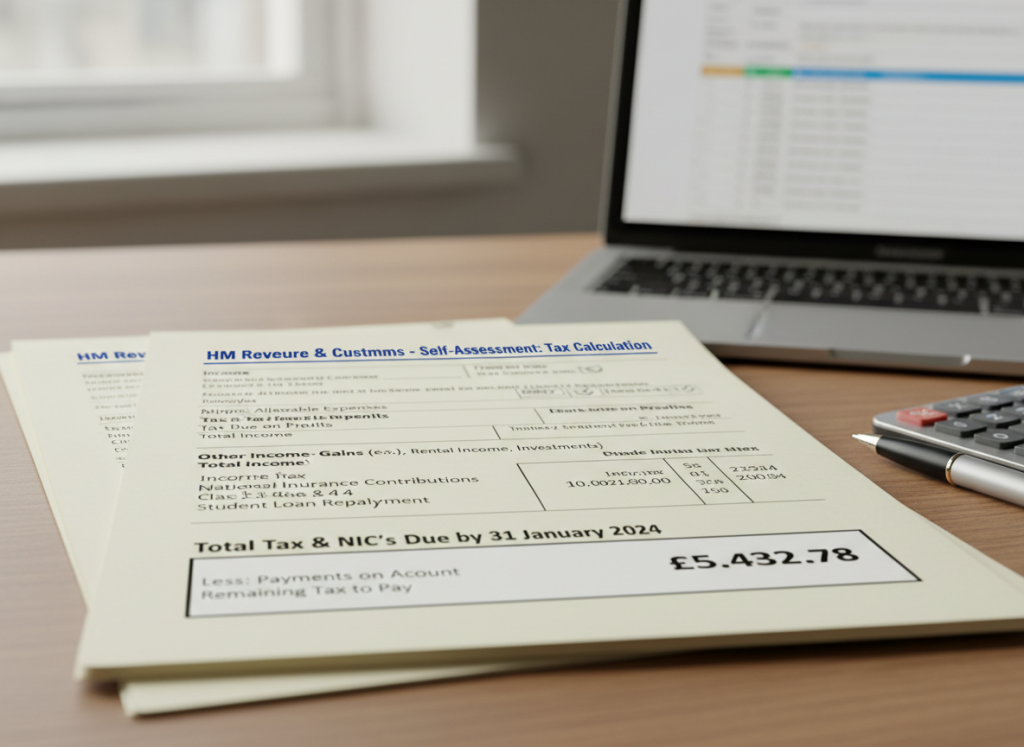

- PAYE vs. Self-Assessment: Most employment income is taxed via Pay As You Earn (PAYE) by the employer. However, if income thresholds lead to under/overpayment (e.g., due to allowance taper), adjustments may be needed, potentially via Self-Assessment.

These thresholds ensure progressive taxation, with higher earners paying more proportionally. For 2024/25, HMRC can often handle allowance taper adjustments via PAYE tax codes without requiring Self-Assessment for pure PAYE employees.

Employment Income

HMRC Self-Assessment is typically not required if your only income is from direct employment taxed fully via PAYE. However, even with solely employment income, you may need to file if certain criteria are met (e.g., due to income levels or specific circumstances). For the 2024/25 tax year:

- High Income Thresholds: Previously, income over £100,000 (or £150,000 for 2023/24) often required Self-Assessment due to Personal Allowance taper calculations. For 2024/25, this is no longer automatic if all income is PAYE-taxed, as HMRC can adjust via your tax code. However, if your employer cannot or does not fully account for the taper, or if you need to confirm/claim adjustments, Self-Assessment may still be needed.

Information to Enter in Each Box on the Tax Return

For HMRC Self-Assessment based solely on employment income, the main form (SA100) requires basic tailoring (e.g., answering “Yes” to having employment income and indicating the number of employments), but detailed employment information goes in the SA102 supplementary page. Below is a list of every box on SA102 and the required information, focusing on direct employment income only. (SA100 has no dedicated employment boxes beyond tailoring questions; all specifics are in SA102.)

Use a separate SA102 page for each employment.

- Box 1: Pay from this employment – Enter the gross pay before tax deductions (from P60 “In this employment” or P45 “Total pay in this employment”). Include furlough payments or disguised remuneration loans. If negative due to clawback, enter 0 and claim relief elsewhere.

- Box 2: UK tax taken off pay in box 1 – Enter UK tax deducted (from P60 or P45). Use a minus sign if refunded (indicated by ‘R’). Include tax on disguised remuneration paid by employer.

- Box 3: Tips and other payments not on your P60 – Enter untaxed tips or gratuities not from employer (e.g., direct customer payments).

- Box 3.1: Pension contribution – payment from HMRC – Enter HMRC top-up payments for net pay pension schemes.

- Box 4: PAYE tax reference of your employer – Enter employer’s PAYE reference (from P45/P60). Write “None” if absent.

- Box 5: Your employer’s name – Enter full employer name.

- Box 6: If you were a company director – Put ‘X’ if you were a director (even part-time).

- Box 6.1: If you ceased being a director before 6 April 2025 – Enter cessation date (DD MM YYYY) if applicable.

- Box 8: If this employment income is from inside off-payroll working engagements – Put ‘X’ if income from IR35/off-payroll rules (e.g., via personal service company with deductions paid to HMRC).

- Box 8.1: If box 1 includes any disguised remuneration income – Put ‘X’ if applicable.

- Box 9: Company cars and vans – Enter cash equivalent (from P11D, if not payrolled).

- Box 10: Fuel for company cars and vans – Enter cash equivalent or amount foregone (from P11D, if not payrolled).

- Box 11: Private medical and dental insurance – Enter value (from P11D, if not payrolled).

- Box 12: Vouchers, credit cards and excess mileage allowance – Enter values (from P11D, if not payrolled; e.g., vouchers over limits or mileage above approved rates).

- Box 13: Goods and other assets provided by your employer – Enter market value (from P11D, if not payrolled).

- Box 14: Accommodation provided by your employer – Enter cash equivalent (from P11D, if not payrolled).

- Box 15: Other benefits (including interest-free and low interest loans) – Enter total value (from P11D, if not payrolled).

- Box 16: Expenses payments received and balancing charges – Enter amounts (from P11D, if not payrolled).

- Box 17: Business travel and subsistence expenses – Enter allowable expenses you paid (e.g., business mileage shortfall below approved rates; keep records).

- Box 18: Fixed deductions for expenses – Enter flat-rate allowances (e.g., for tools/clothing; from tax code or standard rates).

- Box 19: Professional fees and subscriptions – Enter approved professional body fees.

- Box 20: Other expenses and capital allowances – Enter other allowable costs (e.g., home working, equipment; claim capital allowances for qualifying items).

Checklist of Documents, Evidences, Receipts, Invoices, and Forms

Usually you will need:

- P45 (‘Details of employee leaving work’)

- P60 (‘End of Year Certificate’)

- P11D (‘Expenses and benefits’)