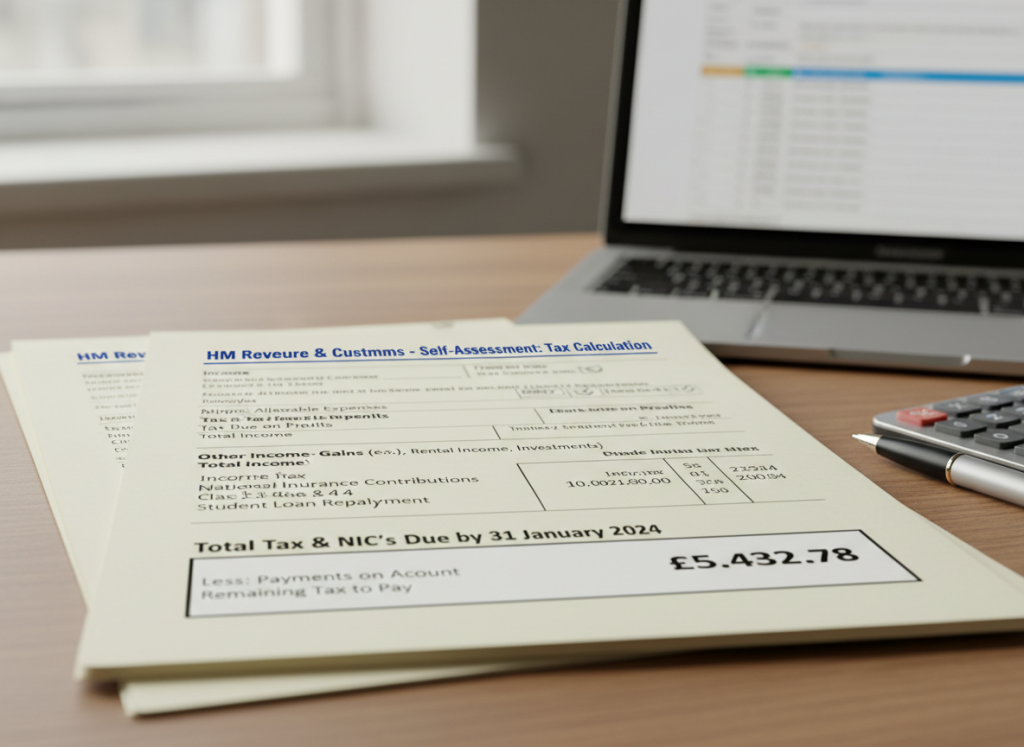

Here’s a numerical example showing how HMRC calculates your expected liability under Self Assessment

Example: Calculating Expected Liability

Background

- Your total tax and Class 4 National Insurance liability for 2023/24 (after PAYE and other credits) = £12,000.

- You are self-employed and still trading in 2024/25, so HMRC assumes your next year’s liability will be roughly the same.

Step 1 – Work out the payments on account

Expected liability for 2024/25 is based on 100% of the previous year’s liability, split into two instalments:

[£12,000 × 50% = £6,000 \text{ per instalment}]

- 1st Payment on Account (POA) – due 31 January 2025 = £6,000

- 2nd Payment on Account (POA) – due 31 July 2025 = £6,000

You will therefore have paid £12,000 on account by 31 July 2025.

Step 2 – File the 2024/25 tax return

Suppose your actual tax liability for 2024/25 turns out to be £13,500.

Step 3 – Work out the balancing payment

[Actual liability (£13,500)} − \text{Payments on account (£12,000)} = £1,500]

That £1,500 is your balancing payment, due 31 January 2026.

Step 4 – Calculate next year’s payments on account

HMRC will now base your 2025/26 expected liability on this latest figure (£13,500), unless you claim to reduce it.

[£13,500 × 50% = £6,750 \text{ per instalment}]

So your next two payments on account will each be £6,750, due 31 January 2026 and 31 July 2026.

Step 5 – If your income drops

If you know your 2025/26 profits will be lower, you can apply to reduce your payments on account.

For example, if you expect your liability to fall to £10,000, you can claim to reduce each POA to:

[£10,000 × 50% = £5,000]

If you reduce too much and end up owing more, HMRC will charge interest on the shortfall.